|

The Quick Entry screen was designed to facilitate

efficient entry of hours. All employees selected from the Employee List appear on the reporting lines

ready for time entry. Start keying time and simply use the tab key to move

to the next field where time is to be entered. When you are finished, click

on the Update button and all time you have entered will be saved.

If you need to change any pay line information you will need to make the

change(s) on the Detail Entry screen. To make

these changes you need to first move to the reporting line of an employee

you wish to make a change and then select the "Detail Entry"

button. This will take you to the Detail Entry screen where the change(s)

can be made. When you have finished making changes, you can select the "Quick

Entry" button on the Detail Entry to return back to the Quick Entry

screen.

- PAY PERIOD

INFORMATION

- Shows the pay period information for time entry that was selected on

the Timekeeper Selection screen.

- DETAIL ENTRY BUTTON - Clicking on this

button will take you to the Detail Entry screen for the selected

employee.

- EXIT - Clicking on this

button will exit you from hours entry and

return you to the Timekeeper Selection screen.

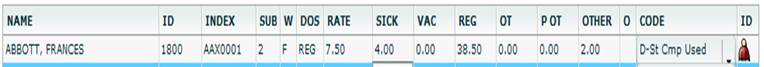

- EMPLOYEE REPORTING

LINES

- Only employees that were selected on the

Employee List screen will be shown with reporting lines available

for time entry.

- CANCEL - Clicking on this

button will cancel all hours entries made during this session on the

Quick Entry screen.

REPORTING LINES INFORMATION

- EMPLOYEE NAME - Employee's name

(Last, First MI), populated from the Payroll Personnel System (PPS).

This data field cannot be changed.

- ID - Employee

identification number generated by PPS. This data field cannot be

changed

- INDEX - Indicates the employee's

index funding source. This data field can be overridden on the Detail Entry screen.

- SUB – Sub account type

which determines timekeeping reporting requirements.

- W – Work study code, which

indicates a PPS work study distribution.

- DOS - Description of

Service code that indicates the type of service or time to be reported

against the departmental funding source for this pay reporting line.

This data field can be overridden on the

Detail Entry screen.

- RATE - Indicates the

rate of pay for this pay reporting line. Biweekly rates are expressed

as an hourly pay rate. Salaried employees are expressed as a monthly

pay rate or 1/12 th

of their annual rate. This data field can be overridden on the Detail Entry screen.

- SICK - Sick leave hours

entered for this pay reporting line. Hours entered in this field will

reduce the employee's sick leave balance accordingly, and will create

pay for sub 2 employees.

- VAC - Vacation leave

hours entered for this pay reporting line. Hours entered in this field

will reduce the employee's vacation leave balance accordingly, and

will create pay for sub 2 employees.

- REG - Regular hours

(actual or estimated) entered in order to create pay for positive time

reported (sub 2) employees. It is not necessary to enter hours for exception

time reported employees (sub 0, sub 1).

- OT - Straight overtime

hours entered to create pay for eligible employees on all sub account

types. Hours reported will be paid at the employee's regular rate of

pay. Overtime hours worked for "comp time" purposes should

not be reported here, but in the other hours field using the

appropriate other hours code (see below).

- PREM OT -

Premium overtime hours entered to create pay for eligible employees on

all sub account types. Hours reported will be paid at the premium rate

of time and a half according to the Fair Labor Standards Act and the

appropriate labor contracts. In most cases this means any hours actually

worked in excess of the employee's standard 40 hour work week.

Premium overtime hours worked for "premium comp time"

purposes should not be reported here, but in the other hours field

using the appropriate other hours code (see below).

- OTHER CD -

Other hours and code fields allow you to enter time for all other

purposes as described below:

A : Administrative Leave

with Pay (creates pay for sub 2)*

B : Voting Time Off

(creates pay for sub 2)*

C : Straight Compensatory

Time Earned (does not create pay for any employee, but adds the

hours reported to increase the employee's Comp balance on the LASR)

D : Straight Compensatory

Time Used (creates pay for sub 2 and for all employees, reduces

employee's Comp balance on the LASR by the number of hours reported)

H : Holiday Time

(creates pay for sub 2)*

J : Jury Duty (creates

pay for sub 2)*

K : TRIP Bonus Time Used

(creates pay for sub 2 and for all employees, reduces the employee's

Paid Time Off balance by the number of hours reported)

L : Other Leave with Pay

(creates pay for sub 2)*

M : Military leave with Pay

(creates pay for sub 2)*

N : No-Pay Absence without

Pay (used only with sub 1 salaried employees to reduce their

number of regular hours to be paid, should not be used for sub 0

Academic employees)

P : Straight Compensatory

Time Payoff (Used to pay employees for Straight Comp Time balance

when separating from UCSD or upon transfer to another department.

Creates pay for all employees and deducts the reported time from the

employee's Comp balance on LASR)

T : Premium Compensatory

Time Used (creates pay for sub 2 and for all employees, reduces

the employee's CMP+ balance on the LASR by the number of hours

reported)

W : Worker's Compensation

Leave (creates pay for sub 2 and should only be entered upon

advice of the Business Office and/or Payroll Office)

X : Premium Compensatory

Time Earned hours must be converted to time and a half before entering,

for example, 4 premium comp hours worked would be converted and

entered as 6 hours (does not create pay for any employee but adds the

reported hours to the employee's CMP+ balance on the LASR)

Z : Premium Compensatory

Time Payoff (Used to pay employees for Premium Comp Time balance

when separating from UCSD or upon transfer to another department.

Creates pay for all employees and deducts the reported time from the

employee's CMP+ balance on LASR)

* These codes are mandatory

nonproductive codes for hospital funded (63XXX) use and optional

nonproductive codes for campus funded use as approved by the

Accounting Office.

|